One of the most impactful pieces of legislation affecting retirement accounts in decades was signed into law on December 20, 2019 at the eleventh hour of the legislative year. The SECURE Act (Setting Every Community Up for Retirement Enhancement Act) became effective on January 1, 2020, and it completely recalibrates how retirement accounts should be addressed in your estate plan.

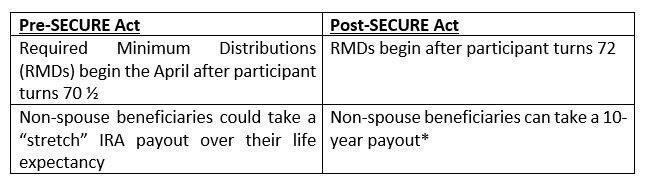

Here is a brief synopsis of the changes the SECURE Act has brought us:

*Exceptions to the 10-year payout are provided for spouses; beneficiaries who are not more than 10 years younger than the account owner; the account owner’s children who have not reached the “age of majority;” disabled individuals; and chronically ill individuals.

It is estimated that the US government will see an increase in tax revenue of 16+ billion dollars over the next 10 years as a result of this legislation. This, in and of itself, may explain why this law was pushed forward.

What Does This Mean for Your Estate Plan?

So, where does this leave the average citizen when it comes to their estate plan? First, a 10-year stretch is still better than no stretch when it comes to your beneficiaries. It is a good idea to take this opportunity to review your beneficiary designations on your retirement accounts and update them if necessary.

Next, your trust is still a good option as a beneficiary for all of the asset protection reasons you built your trust in the first place. The SECURE Act should not cause you to go and reset your beneficiary designations to something/someone other than your trust as a primary or secondary beneficiary. If you have concerns, please schedule a document review appointment with your JGB attorney to address your specific questions before taking action that could impact your estate plan negatively.

Options to Consider

There are additional options that may be considered to mitigate the impact of the SECURE Act on your beneficiaries. You can consider converting your traditional retirement accounts to Roth accounts. In doing this, you will recognize the income tax now so that your beneficiaries will not be required to when they inherit the account upon your death.

You can also use your RMDs now to purchase life insurance and hold that life insurance in an ILIT (Irrevocable Life Insurance Trust). This will ensure that the proceeds you leave to your beneficiaries are not only income tax free but also estate tax free, and they continue to benefit from the asset protection that the trust provides your beneficiaries from their divorces, lawsuits, etc.

Finally, you can look at a Charitable Remainder Trust (CRT). For charitably inclined individuals, a CRT may be the right solution to plan for the disposition of your retirement accounts. Such a trust would allow the individual, as the grantor, to name beneficiaries to receive an income stream from the retirement account for a period of time, with the remainder going to a charity named in the trust agreement.

When the CRT is created, the net present value of the remainder interest must be at least ten percent of the value of the initial contribution. It can be payable for a term of years, a single life, joint lives, or multiple lives. Upon the plan participant’s or account owner’s passing, the estate will receive a charitable deduction for distributing the retirement account to the trust, and the distribution from the retirement account to the CRT is not taxed. However, distributions from the CRT to the beneficiaries will be subject to income tax. Another benefit to this strategy is that the distributions to the beneficiaries will be smaller and, therefore, subject to less income tax liability.

It is important to note that this strategy is best for individuals who are already charitably inclined. This strategy may not result in the beneficiaries getting more than they would have utilizing other estate planning strategies, but if you already wish to provide for a charity, this may achieve your goals in a more tax favorable way.

As discussed, the SECURE Act is pivotal legislation that impacts almost everyone. It is critical that you address the SECURE Act in your estate plan. For JGB TrustGuard™ clients, in addition to our normal annual review items and updates, we will certainly be addressing the impact of the SECURE Act on your trust plans with you. If you are not a JGB TrustGuard™ client, then you should consider scheduling a document review appointment with your JGB attorney to discuss whether the SECURE Act affects your estate plan.

TrustGuard™ 2020

TrustGuard™ enrollment for 2020 is now open. TrustGuard™ is our proprietary, process-driven program, designed for our clients who are serious about protecting their investment in their Trust-based Estate Plan with an annual review. A subscription to TrustGuard™ includes an annual review of your estate plan and funding for the enrollment year, along with any required changes to your plan. Enrollment invitations were sent out to all our currently enrolled TrustGuard™ clients, as well as our clients who executed their documents in 2019.

Enrollment for the 2020 TrustGuard™ period ends on February 28, 2020. JGB clients who choose not to re-enroll during the enrollment period will not have another opportunity to become members of TrustGuard™.

Participation in TrustGuard™ is entirely voluntary. The TrustGuard™ enrollment subscription is billed at an annual flat rate. Clients who pay their enrollment in full prior to February 1, 2020 receive a $100 discount off the price of full enrollment. Contact our office if you are interested in subscribing to the TrustGuard™ program.

DID YOU KNOW?

*JGB will launch a new newsletter specifically designed to meet the needs of our valued TrustGuard™ clients. This new newsletter will be published quarterly with a focus on keeping our TrustGuard™ clients up-to-date on all the newest developments in the world of taxes and estate planning, as well as providing practical advice on how to keep your estate plan in top condition. Look for this new TrustGuard™ exclusive newsletter in February 2020.

*Did you know communicating responsively to our clients is important to us? If you send us something and don't hear from us, please give us a call to confirm we received it.

*Did you know that the attorneys at Johnson, Gasink and Baxter, LLP have built their practice by working with great clients like you?

About the Author:

Jeremy C. Johnson is a Partner with Johnson, Gasink & Baxter, LLP (“JGB”). As a trust, estate and business attorney, he is a proven problem solver who has helped thousands of individual and business clients over his 20+ years of practice, taking pride in ensuring that his work for clients is reliable, correct and on time.

Jeremy earned his bachelor (English) degree from the University of Massachusetts at Amherst, MA; his Juris Doctor from Western New England University School of Law in Springfield, MA; and his LL.M. in Taxation from Boston University School of Law in Boston, MA. He maintains licenses to practice law in both Virginia and Massachusetts.

Having relocated to Virginia in 2004, Jeremy is active in the Williamsburg community. He has served on multiple boards over the years, and he is a returning instructor for SCORE programs sponsored by the Chamber. He has four children and enjoys living, working and playing in Williamsburg with his wife, Sarah Kuehl Johnson.